Hard Rock Lithium

Lithium is currently produced from two main deposit types: hard rock and brines. The largest concentrations of lithium-containing minerals are found in hard rock granitic pegmatites. The most important of these minerals are spodumene and petalite (SGS, 2019). Spodumene is considered the most economically viable source of lithium with typical lithium grades between 0.5 and 2.5% Lithium oxide (Li2O).

Why Hard Rock Lithium?

- Hard Rock Vs. Brines

- Lower Cost, Lower Risk, Faster

- Hard Rock CapEx and OpEx

- Excess Spodumene Conversion Capacity

- Strong Pricing and M&A Activity

Hard Rock Vs. Brines

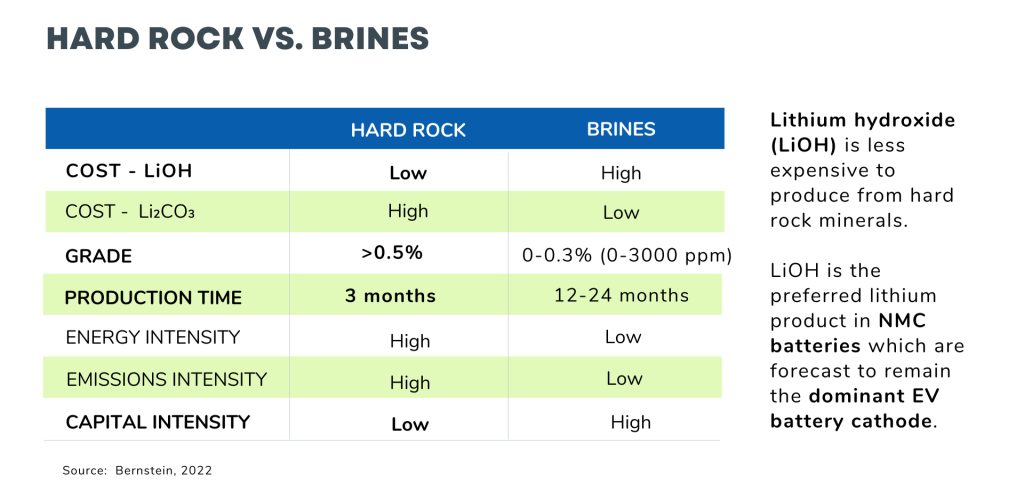

There are two main forms of lithium: lithium carbonate (Li2CO3), and lithium hydroxide (LiOH). Lithium hydroxide is less expensive to produce from hard rock minerals including spodumene. LiOH is the preferred lithium product in NMC batteries (the cathode is made of a combination of nickel, manganese and cobalt) and lithium carbonate is preferred in LFP batteries (the cathode is made of lithium iron phosphate). NMC lithium batteries are forecast to remain the dominant EV battery cathode type due to the superior energy density which improves vehicle range and charging speeds.

Lower Cost, Lower Risk, Faster

Hard rock lithium mineral mines are expected to play a major role in lithium supply as they have demonstrated to be less capital intensive and, a significant volume of excess spodumene conversion capacity exists in China. Lithium demand is forecast to require the equivalent of 50 new lithium mines by 2030 at an estimated cost of US$44 billion in capex spend (at 40k mt Lithium Carbonate Equivalent units), of which 30 new mines are expected to come from greenfield projects (Bank of America Global Research, 2022).

- Hard rock lithium projects may be brought online capex light and operationally straightforward compared to lithium brine projects.

- Lithium production from hard rock projects shown to be faster to market.

- Total lithium production from hard rock resources currently estimated at 450kmt however, is expected to increase more than 3 fold to 1,547kmt by 2030.

- Of the US$43.8 billion total capex requirement estimated to meet lithium demand from 2021 to 2030, US$25.3 billion is forecast to come from bringing hard rock lithium mines online.

- This represents an increase in market share from 55% of current production to 65% by 2030.

Hard Rock CapEx and OpEx Summary

Harvesting lithium from brines through traditional ponding techniques, while low cost is a very drawn out and capital-intensive process. All in, development of a new brine mine from exploration to production can take 7- 8 years. Capital investment for constructing brine projects has also increased considerably over the past few years.

- Capex for brine operations currently under construction in Argentina have been revised up to US$18,500/mt of lithium carbonate.

- Whereas capex for hard rock lithium mines currently under development are coming in at a capex average of US$4,833/mt of lithium carbonate (Bank of America Global Research, 2022).

Excess Spodumene Conversion Capacity

China has materially expanded its spodumene conversion capacity over the last few years. In particular, significant investment has been made toward increasing conversion capacity for spodumene to lithium hydroxide, which is expected to continue (Bank of America Global Research, 2022).

In hard rock lithium production, after the spodumene ore is filtered out of the host rock, it is sent to a chemical converter (typically in China), which upgrades the product into carbonate or hydroxide through either acidic, alkaline, and chlorination processes. This excess supply of spodumene conversion capacity provides immediate facilities for spodumene concentrate growth without downstream investment.

Strong Lithium Pricing and M&A Activity

Lithium pricing hit record highs in 2022 on supply shortfalls and strong demand. In September 2022, Benchmark Mineral Intelligence reported lithium prices of battery grade carbonate hit US$73,525 and lithium hydroxide reached US$72,825 per metric ton.

The 300% year-over-year increase in lithium prices is delivering strong earnings and cash flow to lithium producers resulting in high levels of M&A activity as exploration and development stage companies with strong projects are targeted for acquisition by larger companies.